Table of Content

By having the right mix of stocks, bonds, and cash reserves, your assets will be able to maintain value in poor market conditions and increase in value when the market is doing well. Contributions to a qualified plan, participation in a company-sponsored cafeteria plan, change in filing status, or number of allowances claimed will have a direct impact on take-home pay. For example, due to federal tax savings, contributions to a qualified plan do not translate into a direct dollar-for-dollar tradeoff on take-home pay.

It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice. You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Current Age

Estimate how much you can potentially save by replacing paper checks with paycards. Learn more about Privacy at ADP, including understanding the steps that we’ve taken to protect personal data globally. At ADP, we are committed to unlocking potential — not only in our clients and their businesses, but in our people, our communities and society as a whole. Tap into a wealth of knowledge designed to simplify complex tasks and encourage strategic decisions across key functions. Focus on what matters most by outsourcing payroll and HR tasks, or join our PEO. Manage labor costs and compliance with easy time & attendance tools.

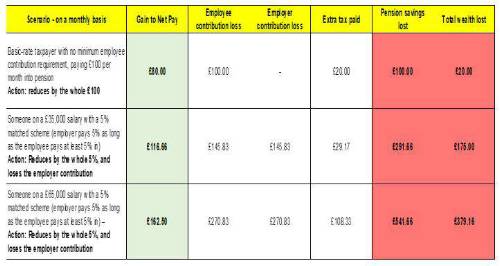

By increasing your contribution to $300, you'll only pay around $255 per month for federal taxes. You've added $100 to your 401 and you're now paying $15 less in taxes per check. Your increased contribution of $100 has really only affected your take-home pay by $85.

Paycheck impact calculator

By investing in a 401, you'd immediately take home $585 extra in tax savings. If your employer matches 3% of your salary, you'd get an additional $975 deposited into your retirement account for free. Assuming a 4% annual market rate of return, your account would also generate $169 of interest. At the end of the year, that's an additional $2,314 in your pocket and retirement account just for contributing to a 401. 401 contribution calculator is a subset of 401 wherein first, we shall calculate the employee contribution amount, which cannot exceed $19,000.

Of course, a saver isn't restricted to a specific incremental increase, and higher bumps up are a good thing. The money you contribute now will grow exponentially over the years, and it's important not to waste the extra time you have to grow your retirement savings. Many people are hesitant to begin investing in 401 plans through their employer because they're worried about how it will affect their take-home pay.

Federal 401k Calculator

Since he has completed five years in the firm, as per the firm’s policy, the company will invest 50% of his annual contribution, subject to a maximum of 8% of the annual salary. Mr. A is contributing 10% of his annual salary and is willing to do so for the next 30 years. He has been earning $30,000 a year, which is paid semi-annually. When he withdraws the amount at the time of retirement, he will be liable for tax on the entire amount since the contributions are made pre-tax and deductions have been taken. The Daily Upside Newsletter Investment news and high-quality insights delivered straight to your inboxGet Started Investing You can do it. In the end, therefore, the tax benefits of your contribution will show up in your take-home pay in each paycheck.

Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. Keep in mind that, while we used 401k as the example type of account, the same could apply to a 403b, or other sort of tax-deferral account.

Note that the tax calculations are based on your overall tax rate. Every day, get fresh ideas on how to save and make money and achieve your financial goals. Living on a fixed income during retirement doesn't mean you have to settle for living somewhere that doesn't meet your needs. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Prosper with Purpose® When you invest with us for your financial future, you also invest in the future of others. This can be a good option if you are not worried about lowering your taxable income.

Use this take home pay calculator to help compare your current situation to what-if scenarios. Chris Brantley began writing professionally for a financial analysis firm in 1997. From 2000 to 2004, he worked as a financial advisor, specializing in retirement planning and earned his Series 7, Series 66 and insurance licenses. Brantley started his full-time writing career in 2012 and has written for a variety of financial websites, including insurance, real estate, loan and investment sites. He holds a Bachelor of Arts in English from the University of Georgia. That represents an increase in your take home pay compared to what would happen if you contributed the same amount to a taxable account.

As a result, your take-home pay will only decline by the difference between $200 and $30, or $170. Each individual decides how much of their paycheck they want to contribute to their 401 plan. You aren't required to put any money into your plan, but you may forfeit matching contributions from your employer if you don't contribute.

Further, the employer contribution will also be calculated subject to limits decided by the individual’s employer. But there are several benefits to establishing a plan, including that contributions you make can lower your taxable income. Contributing to an employer-sponsored 401 retirement plan can be a great way to save money toward your long-term financial goals. That's because of the interaction between contributions you make and how much money is withheld through Form W-4. Let's look more closely at how these two tax topics relate to each other and what you can do to account for both properly. The advantage of traditional 401 plans is that you contribute with pre-tax dollars.

The last time the Social Security Administration made changes to the retirement age was nearly 40 years ago, and those rules still apply today. Bob Haegele is a personal finance writer who specializes in topics such as investing, banking and credit cards. He left his day job in 2019 to pursue his passion for helping people get out of debt and build wealth. You can find his work at outlets such as Business Insider, Forbes Advisor and SoFi. Contribution limits are different for SIMPLE plans than for the other types of 401 plans.

There is a lot to consider as you decide how to fund your retirement. To ensure that you get the results you want, it is important to align your full financial situation with your financial goals and to speak with a professional. Some employers allow participants to their traditional 401 plan to convert their plan to a Roth 401 while they are still employed at the company. Although this option is not widely available, it can be beneficial.

Traditional 401 plans are one of the most common retirement plans in the U.S. With the traditional 401, you generally contribute to a plan through your employer via payroll deduction. Your employer might also make matching contributions, which may or may not require you to wait a certain number of years before you are fully vested. For example, imagine you are contributing $500 per month to your 401 every month via payroll deduction.

In addition, they are similar to safe harbor plans in that matching contributions are immediately fully vested. Another key difference with safe harbor plans is that matching contributions are fully vested immediately. In other words, employees can’t be required to wait a certain number of years before they are fully vested; that happens as soon as money is contributed. There are multiple types of safe harbor plans, such as basic plans and enhanced plans. With basic plans, employers match 100% of contributions up to 3% of employee compensation, and 50% of contributions up to 5% of compensation.

No comments:

Post a Comment