Table of Content

Increasing your 401 contributions today may greatly improve your retirement outlook. Use our 401 contribution calculator below to see how that extra money could affect your paycheck and your future. The more aggressive your portfolio allocations, the higher the potential returns — but investments can drastically peak and valley over short periods of time. The closer you are to retirement, the less aggressive you want to be with your assets. Over time, you may want to reduce the percentage of stocks in your plan in favor of bonds, cash, and other investments that are more stable over the short term.

Talk to a financial advisor who can take you through the steps and help you set up an account if you're at all uncertain about how to start investing for retirement on your own. This article is reprinted by permission from NerdWallet.The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. The impact of your contributions and tax savings on your take home pay. As you can see, going with the ‘wait until next year’ strategy can have a significant effect on future savings. Retirement comes faster than you think, and by not starting a plan now, you and your employees are missing out on compound interest.

Calculator: How 401(k) Contributions Affect Your Paycheck

Rebalancing a portfolio is important in maintaining the correct proportions of assets. Over the course of time, some of your assets will do better than others, increasing their percentages within your total investment. It is important to monitor your assets and correct the imbalances to stay within your target allocations.

Use this take home pay calculator to help compare your current situation to what-if scenarios. Chris Brantley began writing professionally for a financial analysis firm in 1997. From 2000 to 2004, he worked as a financial advisor, specializing in retirement planning and earned his Series 7, Series 66 and insurance licenses. Brantley started his full-time writing career in 2012 and has written for a variety of financial websites, including insurance, real estate, loan and investment sites. He holds a Bachelor of Arts in English from the University of Georgia. That represents an increase in your take home pay compared to what would happen if you contributed the same amount to a taxable account.

Federal 401k Calculator

Intraday data delayed at least 15 minutes or per exchange requirements. If you’re a self-employed worker who bills their clients per project, you might consider holding off on invoicing if you think extra income might bump up your 2022 earnings. With the holidays right around the corner, taxes might be the last thing on your mind. But a little bit of preparation now could make a big difference come April. You can see the effect of contributing to a pre-tax account such as a 401 in the pie charts below. Estimate how much an individual or employee can potentially save by receiving their pay on a paycard.

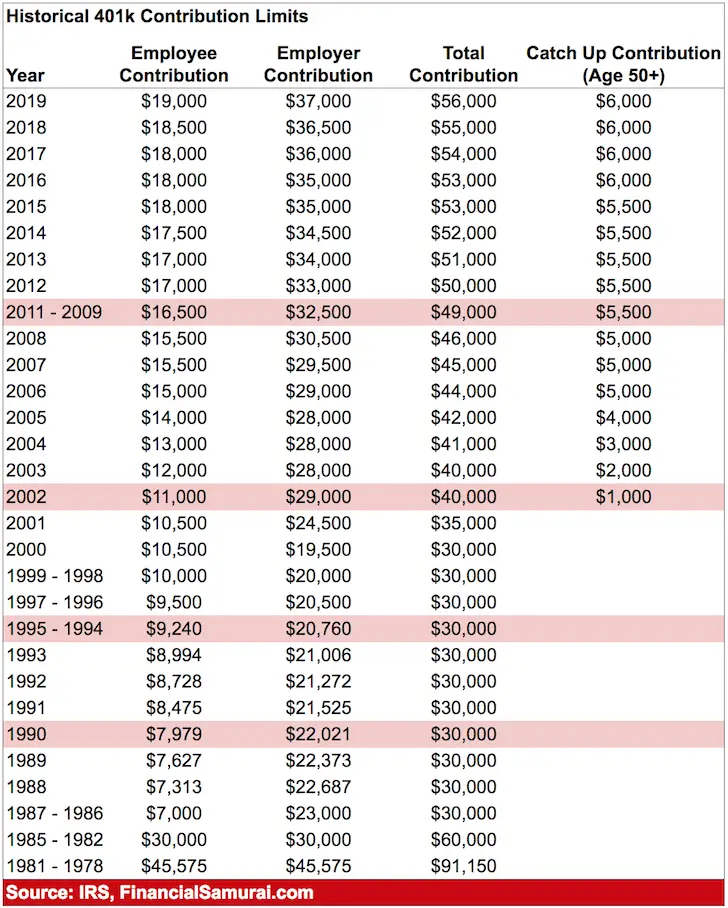

You may now make an additional pre-tax contribution to your plan. Catch-up contributions are treated the same way as any other pre-tax contributions - the amount of contribution decreases your taxable income in the current year. While the other two plans mentioned here are generally for employees working for a large employer, SIMPLE 401 plans were created for small businesses.

How a Roth 401(k) Affects Take-Home Pay

Since he has completed five years in the firm, as per the firm’s policy, the company will invest 50% of his annual contribution, subject to a maximum of 8% of the annual salary. Mr. A is contributing 10% of his annual salary and is willing to do so for the next 30 years. He has been earning $30,000 a year, which is paid semi-annually. When he withdraws the amount at the time of retirement, he will be liable for tax on the entire amount since the contributions are made pre-tax and deductions have been taken. The Daily Upside Newsletter Investment news and high-quality insights delivered straight to your inboxGet Started Investing You can do it. In the end, therefore, the tax benefits of your contribution will show up in your take-home pay in each paycheck.

We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. You'll also benefit from an increased contribution if your employer matches what you put in the 401.

Further, the employer also contributes 30% of his contribution and limits the same up to 7% of the annual salary. The rate of interest that he will earn will be 5% per annum, which will be compounded annually. As you can see, the end result is that you actually have increased your overall money on your balance sheet assets by $52.16, which is a 5.73% increase. Granted, your 401k account and the company match are restricted in access, but your overall situation is a significant increase.

Note that the tax calculations are based on your overall tax rate. Every day, get fresh ideas on how to save and make money and achieve your financial goals. Living on a fixed income during retirement doesn't mean you have to settle for living somewhere that doesn't meet your needs. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Prosper with Purpose® When you invest with us for your financial future, you also invest in the future of others. This can be a good option if you are not worried about lowering your taxable income.

Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. Keep in mind that, while we used 401k as the example type of account, the same could apply to a 403b, or other sort of tax-deferral account.

Lastly, these plans allow employers to avoid nondiscrimination testing. However, they must notify employees of certain things, such as how employees can make elections. Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. The sacrifices you make now will prevent you from making difficult decisions once you retire. You may want to consider other investments if you max out your allowable 401 contributions.

It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice. You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

As a result, when you make a 401 contribution, the taxable part of your total pay goes down. This has an impact not just on how much income goes into your paycheck but also on how much gets withheld for federal and state income taxes. In addition to not paying tax on the money you contribute to your 401, you also don’t have to pay tax on investment returns.

No comments:

Post a Comment